Elon Musk’s xAI has quickly become one of the most closely watched names in AI investing, combining scale, vision, and vertical integration. With direct links between Tesla, X (Twitter), and Grok, xAI offers investors a case study in how to invest in AI startups that sit at the intersection of infrastructure, data, and distribution.

The vision: AI with a purpose

Founded in March 2023 by Elon Musk, xAI quickly positioned itself in the rapidly expanding AI private market with a mission to develop AI that "truly understands the universe." Central to its offering is Grok, a powerful chatbot built on advanced large language models that emphasize reasoning, truth alignment, and multi-modal capabilities including real-time internet search and image generation.

xAI operates across several verticals: consumer AI via Grok, enterprise automation, and government contracts, leveraging its large-scale AI infrastructure and continuous real-time data stream to train models that prioritize accurate reasoning and factual grounding.

In a competitive landscape with leaders like OpenAI, Google DeepMind, and Anthropic, xAI’s edge lies in its seamless integration with Musk’s ecosystem, leveraging millions of active users and a proprietary data environment.

The ecosystem advantage

The company’s integration across Musk’s ecosystem (‘Muskonomy’) gives xAI a unique edge for AI infrastructure investing.

- X (previous Twitter) provides a constant stream of real-time language and sentiment data, arguably one of the richest datasets available for training models. Through Grok, xAI’s conversational AI, this data becomes a monetized intelligence layer embedded within X’s subscription tiers.

- Tesla contributes the physical-world data and compute backbone necessary for multimodal reasoning, a crucial differentiator for investors comparing enterprise vs. consumer AI investments.

- Colossus, xAI’s proprietary compute infrastructure, represents a deeper move into the AI infrastructure investment layer, where control over inference efficiency and cost per token directly impacts valuation.

Together, these create an integrated feedback loop, a “closed ecosystem” that gives xAI both technological and financial leverage.

Model performance and market traction

Grok 4.1, xAI’s latest flagship model, has 2.7 trillion parameters and supports a massive 256,000 token context window for long-form reasoning and complex workflows. It integrates multi-modal abilities (processing text, images, and audio) with real-time web search to provide dynamic, up-to-date responses.

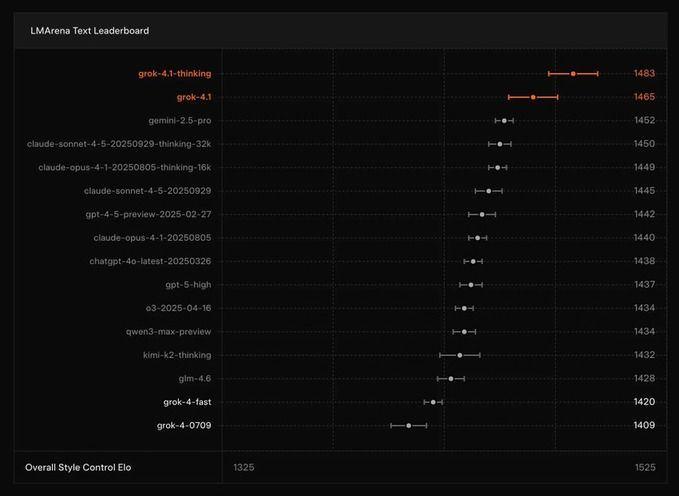

Recent benchmarking positions Grok 4.1, the latest incremental update, outperformed mainstream GPT-4.5 and Claude models and closely trailing GPT-5 advanced previews. The model’s “Thinking Mode” and “Big Brain Mode” dynamically allocate computational resources to optimize accuracy and latency for complex problems[1].

Commercially, Grok powers millions of active users across free and premium tiers, supports enterprise API licensing, and underpins significant government contracts, including a $200-300 million U.S. Defense Department deal, validating its broad market adoption and strategic relevance[2].

Funding, valuation and strategic balancers

xAI has raised approximately $25 billion across eight funding rounds, blending equity and debt to support its capital-intensive AI infrastructure[3]. The company’s last major raise totaled $10 billion earlier this year, backed by Fidelity, BlackRock, and Sequoia. This round valued xAI at approximately $200 billion. The current valuation (i.e., ongoing round) is $230 billion[4], reflecting continued investor interest and market speculation amid a proposed but unconfirmed additional funding round.

Strategically, xAI leverages investments from Elon Musk’s ecosystem, with SpaceX contributing $2 billion and potential investment moves involving Tesla under shareholder review[5]. This inter-company alignment bolsters resource sharing and operational synergy, while also underpinning xAI’s premium valuation despite its comparatively smaller consumer base.

The investment case

xAI offers a rare combination of exponential technological scale, diverse revenue streams, and latent growth optionality. Four core drivers underpin its appeal:

- Muskonomy: Vertically integrated ecosystem spanning X's real-time data (70M+ daily users), Tesla's physical-world sensor feeds, and Colossus deployment—creating proprietary control over data, compute, and distribution unmatched by rivals.

- Diversified revenue with $500M ARR (2025 guidance, scaling to $2B+ 2026) from SuperGrok subscriptions ($30-300/mo), usage-based API, X revenue share, $300M DoD contracts, Hotshot/Orion acquisitions.

- GTM strategy, emphasizing SOC-2 compliance, privacy assurances, development tools, and vertical productivity challenges for OpenAI/Anthropic.

- Social + AI synergy, leveraging Musk's media reach and X’s footprint to drive retention/adoption. Real-time search/insights from X trends enable sentiment analysis across geopolitics, markets, and culture.

- Open philosophy with a truth-seeking, open-source strategy differentiates Grok as a transparent alternative to closed labs, accelerating developer adoption and regulatory favor.

- Unmatched computational power via Colossus, currently the world’s largest AI supercomputer. Colossus enables near-linear scaling of distributed training with ultra-high network throughput and near-zero latency, speeding up Grok model development and real-time iteration[6].

The bottom line

In 2025, xAI embodies the essence of next-generation AI investment: a vertically integrated ecosystem combining reasoning models, real-time data, and monetization channels. Grok leads the rankings while Colossus provides the computing power needed to accelerate AI breakthroughs rapidly.

Its funding rounds this year further signal significant near-term upside. For investors, xAI represents a rare opportunity: it is not only a leader in AI technology but also strategically positioned to capitalize on the trillion-dollar AI infrastructure market. Its unique blend of technological scale, data advantage, and financial backing positions it for material value creation in both the near and long term.

[1] https://www.cometapi.com/grok-4-1-released-how-it-crushes-other-models/

[2] https://ia.acs.org.au/article/2025/xai-wins--300m-govt-contract-days-after-grok-goes-wild.html

[3] https://tracxn.com/d/companies/xai/__saKrxbHN3TRWW-I4lYH6zkx6N5P_kMTqlLcKTzWs2ug#about-the-company

[4] https://www.google.com/url?q=https://www.cnbc.com/2025/11/13/musk-xai-funding.html&sa=D&source=docs&ust=1764544355931118&usg=AOvVaw3g8YuUYEmDegRZqVELE0vj

[5] http://applyingai.com/2025/07/spacexs-strategic-2-billion-bet-on-xai-integrating-grok-into-musks-ecosystem/

Published by Samuel Hieber