Could OpenAI become the first $1 trillion AI company to go public? With unprecedented revenue growth, deep enterprise penetration, and dominance at the model layer, OpenAI sits at the center of AI sector private market growth.

The road to $1 trillion: Hype or reality?

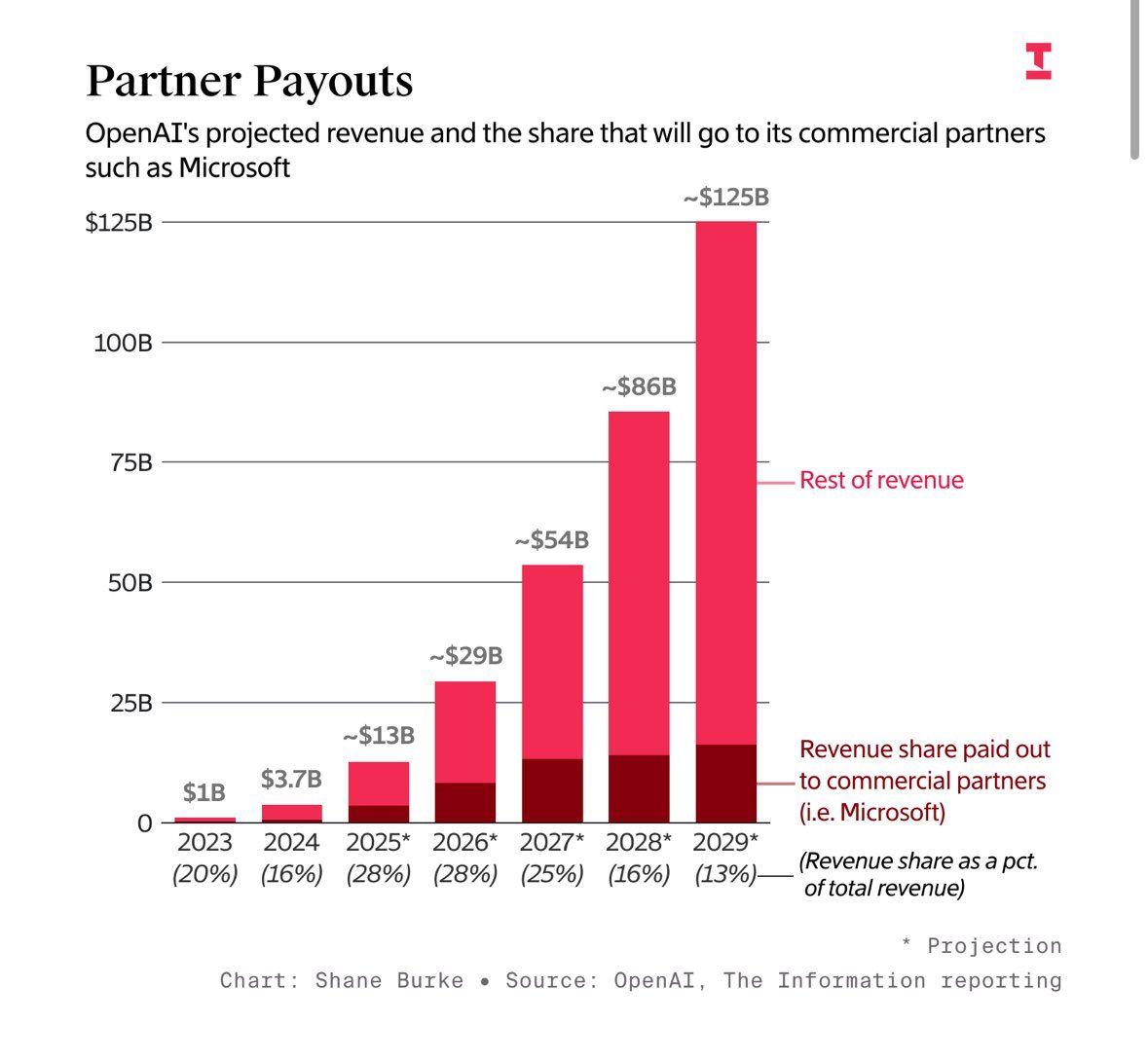

OpenAI’s ascent from research lab to commercial powerhouse has been extraordinarily fast. The company hit $12 billion in annual recurring revenue earlier this year and is on track to reach $15-20 billion by year-end, driven by enterprise API demand, ChatGPT Plus subscriptions, and integrations across the Microsoft ecosystem[1].

This combination of scale and monetization efficiency is why OpenAI consistently appears at the top of lists tracking AI companies to watch in 2025. But the $1 trillion speculation is more about market structure. OpenAI sits at the intersection of foundational model dominance, enterprise adoption momentum, and global AI infrastructure dependence.

Revenue reality: The foundation of the IPO narrative

Unlike earlier tech hype cycles, OpenAI is not growing on sentiment alone. It is one of the rare AI startups with real revenue growth, exhibiting both scale and recurrence. Key drivers include explosive enterprise demand for copilots and domain-specific GPTs, multi-product monetization across ChatGPT Plus, Teams Premium, and Azure AI, and global distribution through Microsoft’s massive enterprise footprint.

- ChatGPT Plus alone boasts over 12 million paying subscribers, with strong retention rates of 74% after three quarters, contributing significantly to recurring revenues[2].

- On the enterprise side, ChatGPT Enterprise now has over 600,000 paying business customers, up 275% year over year, with over 1 million total enterprise customers and 7 million seats globally.

- Over 92% of Fortune 500 companies use OpenAI products or APIs, cementing its position as a core enterprise AI platform[3].

These factors make OpenAI the centerpiece of many institutional AI funds and syndicates, which view the company as the anchor around which the broader AI market is forming.

Enterprise vs. Consumer AI: OpenAI has both

One reason analysts believe a $1 trillion valuation is within reach is OpenAI’s hybrid positioning across enterprise and consumer markets.

On the enterprise front, GPT-based copilots and AI integrations are deeply embedded into workflows across sectors, including healthcare, finance, legal services, and logistics. These enterprise offerings generate approximately 25-30% of revenue from over 3 million paying business users, with ChatGPT Enterprise pricing around $60 per seat per month and Team plans at $25-30 per user monthly[4].

The API and developer platform, representing 15-20% of revenue, shows massive growth driven by GPT-5 API usage in coding, agent-building, and reasoning applications, indicating robust developer and integration adoption. Enterprise monetization strategies focus on high revenue-per-user from tailored contracts, bespoke deployments, and platform integrations, fueling resilient and scalable cash flows.

Few companies capture both ends of the enterprise vs consumer AI investments spectrum as effectively. This duality creates diversified, resilient cash flows, rare for a company at this stage.

The strategic advantage: Infrastructure and distribution

OpenAI’s strategic moat is rooted in AI infrastructure investing. Through its partnership with Microsoft, OpenAI benefits from unparalleled access to global compute resources, deep integration into Azure’s AI stack, and embedded distribution across enterprise suites.

OpenAI has contracted to purchase an incremental $250 billion of Azure services, and Microsoft’s AI revenue has grown 35% year over year, helping solidify distribution and cloud infrastructure synergy for OpenAI[5]. This compute-plus-distribution synergy adds durability to OpenAI’s valuation and reduces execution risk, two crucial components in any rigorous AI valuation models explained framework.

What would it take to make a trillion-dollar IPO possible?

OpenAI's IPO would mark a turning point for the AI sector, but achieving a $1 trillion valuation will depend on much more than current momentum. Microsoft's 27% stake and exclusive cloud partnership remain a double-edged sword: they offer scale and robust infrastructure, but also raise concerns about strategic independence and governance. At the same time, OpenAI's high computing and R&D costs underscore the challenge of balancing innovation with profitability.

The real question is whether OpenAI can translate its technological dominance and revenue scale into sustainable market value and, more importantly, how it can realize this vision.

[1] https://www.cnbc.com/2025/11/06/sam-altman-says-openai-will-top-20-billion-annual-revenue-this-year.html

[2] https://market.biz/chatgpt-statistics/

[3] https://www.christianandtimbers.com/insights/chatgpt-reached-92-of-the-fortune-500-in-24-months#:~:text=In%20August%202023%2C%20OpenAI%20launched,were%20already%20using%20OpenAI%20tools.&text=with%20600%2C000%2B%20paying%20business%20users%20across%20major%20industries.

[4] https://www.saastr.com/openai-crosses-12-billion-arr-the-3-year-sprint-that-redefined-whats-possible-in-scaling-software/

[5] https://openai.com/index/next-chapter-of-microsoft-openai-partnership/

Published by Samuel Hieber