Prediction markets, once a niche corner of crypto and finance, are entering the mainstream. Kalshi and Polymarket now represent two competing visions of how speculation meets information: one regulated, one decentralized. Their rivalry captures not just the future of betting on events, but the financialization of sentiment itself.

The rise (and risks) of the social forecast economy

In 2025, prediction markets are no longer fringe experiments. From elections to inflation data and tech valuations, investors are increasingly pricing what might happen rather than just what has happened

Prediction markets are essentially platforms where people trade contracts based on the outcomes of future events. The price of these contracts reflects the crowd’s belief about the chances of the event occurring. While powerful for forecasting, this creates a potent social risk: when a market's odds are reported as a definitive forecast, it can create a self-fulfilling or self-denying prophecy. Seeing a candidate's odds plummet on a prediction market can discourage donations and voter turnout, actively altering the very outcome it predicts.

Platforms like Kalshi and Polymarket sit at the heart of this transformation bridging retail participation, institutional interest, and the rapidly growing demand for real-time, market-based insight. The core idea is simple: markets aggregate information better than polls or pundits. But the implications, for regulation, financial innovation, and capital allocation, are anything but simple.

Regulation vs. decentralization: Two models, one market

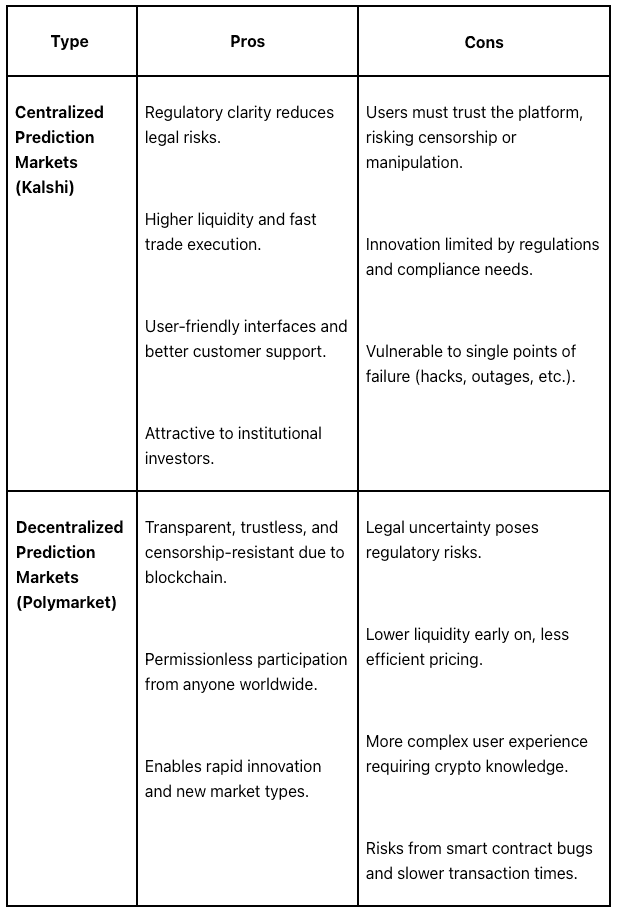

Despite similar missions, Kalshi and Polymarket operate in fundamentally different ecosystems.

Kalshi runs as a CFTC-regulated exchange, the first of its kind in the U.S., having secured regulatory approval to offer federally compliant event contracts. Its contracts allow traders to buy and sell positions on objectively verifiable outcomes, from “Will inflation exceed 3% this quarter?” to “Will the Fed cut rates before June 2025?” As of October 2025, Kalshi has expanded its contract offerings to over 1,000 unique event markets and processes an annualized trading volume exceeding $50 billion[1].

By contrast, Polymarket operates on the Polygon blockchain, using USDC stablecoin for settlement and smart contracts to enforce transparent and trustless outcomes. It is global, permissionless, and faster-growing, having recently surpassed weekly trading volumes of $1.2 billion[2].

Both are chasing the same idea: transforming information into a tradable asset class. But their paths to legitimacy diverge sharply.

The investor lens: data, liquidity, and alpha

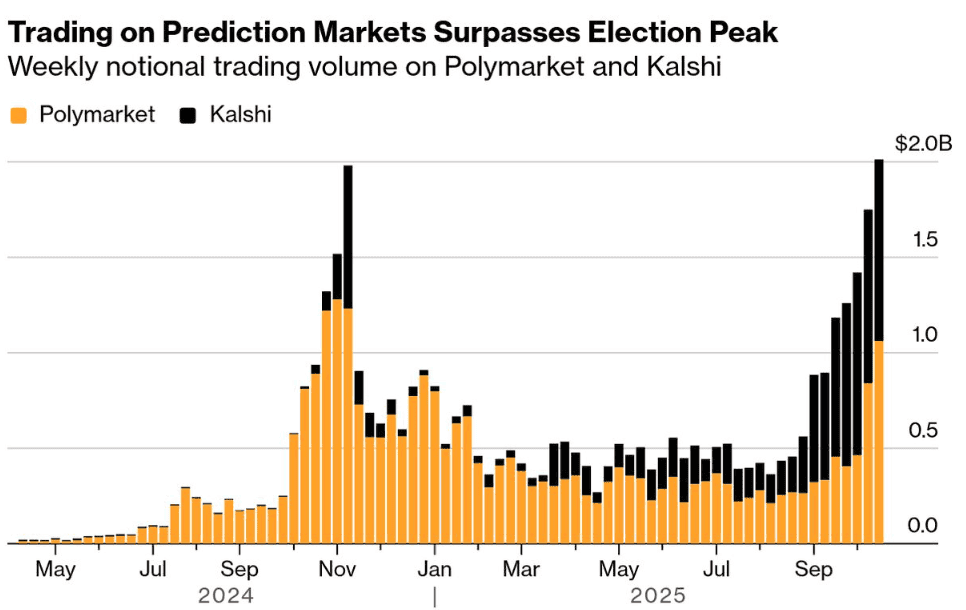

Both Kalshi and Polymarket are experiencing explosive growth in both capital inflows and market participation, signaling a new phase for prediction markets as investable infrastructure rather than speculative platforms.

Kalshi has raised over $300 million in its latest funding round led by Sequoia Capital and Andreessen Horowitz, boosting its valuation to $5 billion in October 2025. Investor interest remains high, with new offers potentially valuing the company at over $10 billion, more than doubling its mid-2025 valuation[3].

Polymarket, meanwhile, raised $200 million in June 2025 at a $1 billion valuation in a round led by Founders Fund. Just months later, in early October 2025, Intercontinental Exchange (ICE)—owner of the New York Stock Exchange—announced plans to invest up to $2 billion in Polymarket at about an $8 billion valuation. A forthcoming round reportedly targeting a $12–15 billion valuation marks a tenfold increase within a few months[4].

This rapid appreciation reflects a broader investor thesis: prediction markets are evolving into highly liquid, institutionally relevant asset classes, with 2025 marking an inflection point in both scale and mainstream adoption. For top-tier investors, the opportunity lies not merely in trading event outcomes, but in owning the infrastructure—the data pipelines, APIs, and compliance rails that commoditize event risk.

With regulatory moats, high-frequency event data, and cross-chain interoperability forming durable competitive edges, the focus now shifts toward scalable compliance technology, event data liquidity, and enterprise-grade signal monetization. In this light, prediction markets are maturing into the next layer of financial information infrastructure—a new category priced like venture fintech, but built to scale like capital markets infrastructure.

[1] https://www.nytimes.com/2025/10/10/business/dealbook/kalshi-prediction-market-fundraising.html

[2] https://finance.yahoo.com/news/prediction-markets-hit-time-high-200142742.html

[3] https://www.bloomberg.com/news/articles/2025-10-22/prediction-market-kalshi-fields-investor-offers-at-over-10-billion-valuation?embedded-checkout=true

[4] https://www.coindesk.com/business/2025/10/23/polymarket-seeks-investment-at-valuation-of-usd12b-usd15b-bloomberg

Published by Samuel Hieber