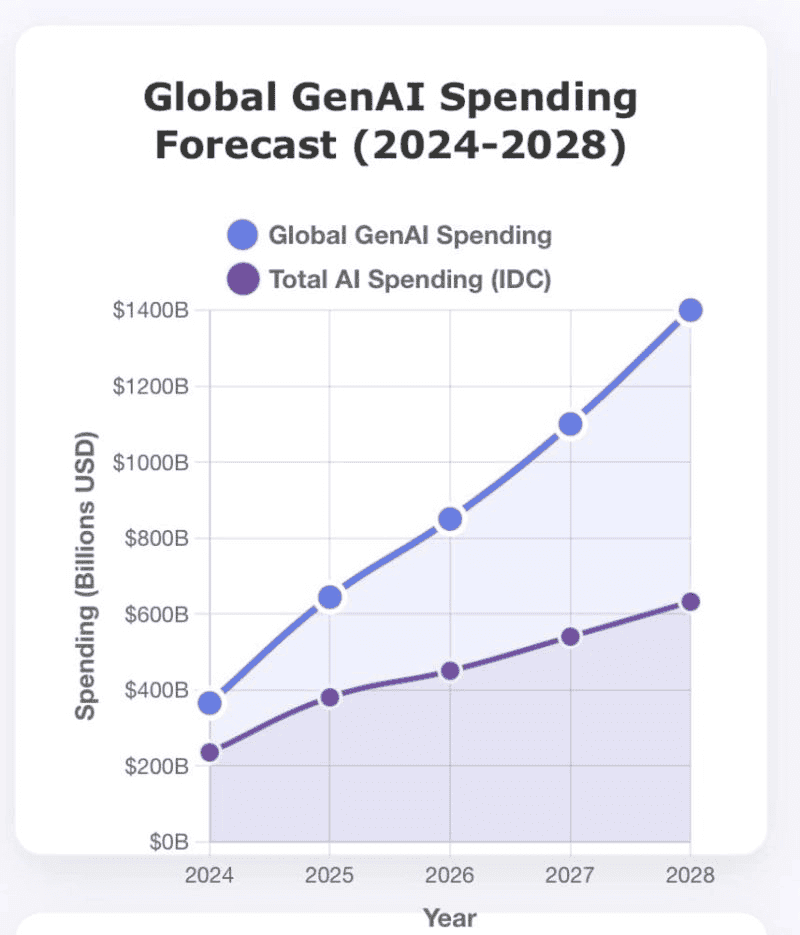

As enterprises race to deploy generative AI at scale, a new rivalry is emerging—not between tech giants, but between a model maker and a service integrator. OpenAI and Accenture are now competing for the same territory: becoming the enterprise’s default AI operating layer. The outcome could redefine where the next $1.3 trillion of projected enterprise AI value (2025–2030) accrues.

The next frontier: AI as a service

In 2025, the narrative around AI has shifted. The question went from “Who builds the best model?” but “Who helps enterprises use it effectively?”. That’s where OpenAI and Accenture now intersect. Global enterprise AI spend is projected to exceed $290 billion by 2026, with consulting and integration services representing 45% of that total[1].

OpenAI, with its GPT platform and enterprise APIs, is embedding intelligence directly into workflows, from copilots to domain-specific GPTs. Accenture, leveraging its massive consulting infrastructure, is translating those capabilities into customized, compliant, industry-ready deployments. Both are building “AI consultancy” empires, but from opposite directions.

When vision meets trust

OpenAI and Accenture are converging on the same challenge from different sides: One needs enterprise trust, and the other needs innovation credibility.

OpenAI’s enterprise expansion has accelerated rapidly, turning GPT into a core productivity layer across Microsoft 365, Salesforce, and SAP. Through its GPT Store, plugins, and fine-tuning APIs, enterprises can now deploy copilots and analytics tools up to 60% faster than before. But as adoption soars—GPT‑5 usage up 380% year-on-year—clients demand tighter security and compliance. To win their trust, OpenAI must evolve from bold innovator to dependable infrastructure provider, managing over 100PB of model data and billion‑dollar inference costs with enterprise‑grade discipline.

Accenture, meanwhile, is scaling in the opposite direction. With $3 billion devoted to AI and partnerships across Google Cloud, Microsoft, and Anthropic, it has turned AI adoption into a product through frameworks like AI Navigator and ModelOps. Yet to capture the full upside of this transformation, Accenture must shift its image—from safe implementer to visionary brand associated with defining, not just deploying, AI.

Two models, one mission

Both companies are tackling the same problem, how to make AI enterprise-ready, however, their business architectures couldn’t be more different:

Attribute | OpenAI | Accenture |

|---|---|---|

Business type | Product-led | Service-led |

Target market | Consumer-first | Enterprise-led |

Revenue model | Subscription-driven | Contract-driven |

Core strength | API scalability | Implementation scalability |

Margin type | Software margin (70-75%) | Service margin (15-18%, trending toward 22-25%) |

2025 projected revenue | $5.2B (est.) | $68B (Accenture FY2025 target) |

AI workforce growth | +250% YoY (1,200 new AI engineers) | +40% YoY (150,000 AI practitioners ) |

OpenAI monetizes intelligence as a product. Accenture monetizes intelligence as transformation. The convergence point, both are building recurring revenue around AI integration at scale.

The margin story

Accenture historically operated on 15–18% operating margins, typical for professional services. With its new AI-powered frameworks, those margins are trending higher, driven by automation and reusable delivery modules. AI is making consulting itself more profitable.

OpenAI, meanwhile, runs at software-level gross margins (estimated 70–75%), but its costs are rising sharply with inference demand and model updates. Its enterprise business remains high-margin, but sustainability depends on efficiency gains and model compression.

For investors, the key takeaway is clear, OpenAI has margin advantage but scaling cost risk and Accenture has margin expansion potential as AI turns services into platforms.

The strategic crossroads

In the next two years, both companies will face pivotal choices. OpenAI will need to move deeper into enterprise infrastructure, governance, model lifecycle management, and private deployment (expected to represent 40% of enterprise deals). On the other hand, Accenture will need to move higher up the stack, creating proprietary AI tooling, not just integration frameworks.

The overlap is inevitable. Accenture is currently hiring 2,000+ AI engineers per quarter, while OpenAI has expanded its enterprise support teams by 180% since 2024. The overlap points to convergence in “AI consulting-as-infrastructure.”

The bottom line

The OpenAI–Accenture dynamic represents the next phase of the AI economy: the industrialization of intelligence. OpenAI brings the engine, Accenture brings the infrastructure. One scales code, the other scales adoption. Both are racing toward one goal: becoming the operating layer for the enterprise AI economy, estimated at $1.3 trillion in annual value creation by 2030[2]. For investors, this rivalry signals where value will consolidate, not just in the models, but in the ecosystem that operationalizes them.

[1] https://www.crn.com/news/ai/2025/top-6-ai-markets-in-1-5-trillion-industry-ai-spending-in-2026-to-hit-2-trillion-gartner

Published by Samuel Hieber