Private equity has been betting big on artificial intelligence (AI) lately. It's no surprise: AI's incredible capabilities have already left their mark on industries across the globe, to the point of becoming the cornerstone of countless businesses, and hence generating substantial returns for the savviest.

We've conceived this article as a high-level view of the AI sector and recent private equity activity, while highlighting the key players worth considering for investment. Let’s get to it.

Overview of the AI sector

An exponential growth pattern has been witnessed in the AI industry over the past 20 years, marked by several key phases:

Mid to late 2000s - Advancements in algorithms and computing power laid the groundwork for modern AI.

Early 2000s - AI was mostly academic, with limited commercial applications.

Mid to late 2000s - Advancements in algorithms and computing power laid the groundwork for modern AI.

2010s - Big data and deep learning led to practical applications in image recognition, natural language processing, and autonomous vehicles, attracting significant investment.

Late 2010s to early 2020s - AI became integral to innovation across sectors like healthcare, finance, and manufacturing, driving the industry's value into the billions.

2020s - AI is now everywhere, fueling operations and breakthroughs across all industries. According to a recent survey, 35% of businesses use AI and approximately half of businesses plan on integrating AI into their processes this year.

The global AI market is currently valued at around $200 billion and is forecasted to reach $1.3 trillion by 2030 - or a compound annual growth rate (CAGR) of 36.8%. AI's expansion is revolutionizing industries, optimizing operations, slashing costs, and elevating customer experiences, notably in sectors like finance and healthcare.

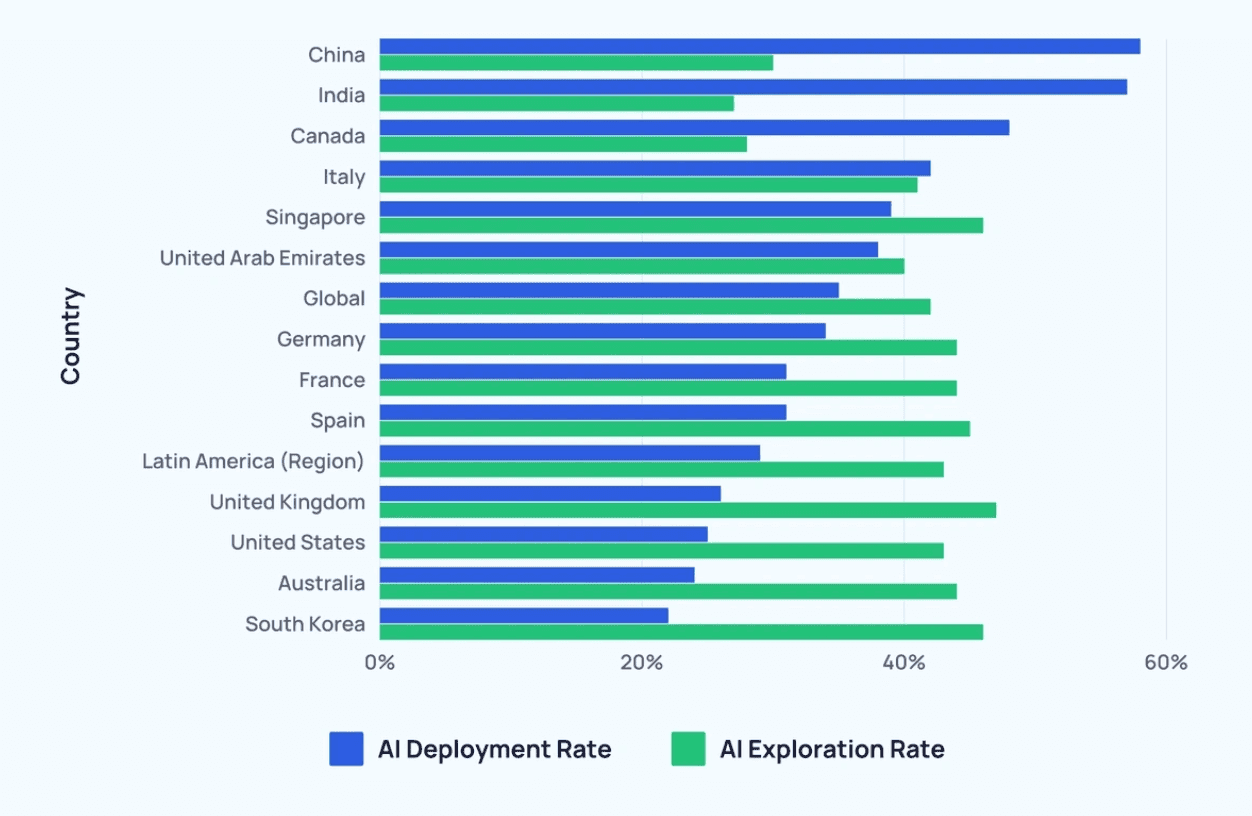

Geographically wise, North America is leading and expected to maintain its dominance - unsurprisingly, most AI ventures originate from there (interestingly, some call it the rebirth of Silicon Valley). Meanwhile, the Asia Pacific region is also poised for rapid growth, fueled by increasing investments across diverse industries such as automotive, healthcare, and retail. EY underlined APAC as a top destination for AI growth - according to their survey, 74% of the companies polled are redirecting capital from other investment projects or technology budgets to invest in AI.

Disruption and Competitive Landscape

Unsurprisingly, AI is driven by tech giants like Google, Microsoft, and Amazon. 92% of companies' current spending on generative AI stems from their solutions (AWS, Azure or G-Cloud). This comes down to the fact that, in addition to their massive in-house R&D capacity and headway in this field, they have been scooping up new players in the space, virtually eliminating outside competition - Amazon’s recent $4 billion investment in Anthropic, Microsoft multibillion-dollar investments in OpenAI, or Google’s acquisition of DeepMind.

But let’s not forget that there’s been a clear democratization - the open-sourcing of languages such as OpenAI and Grok - meaning that top-tier AI tech is now accessible to any developer. This accessibility has fueled innovation and, hence, the emergence of new players developing niche/tailored AI solutions to specific industries and use cases, reshaping the competitive landscape. Figure AI is a perfect illustration, making great strides in robotics.

The Sub Fields

We believe that understanding and differentiating the different AI sub-sectors in which players operate is essential to identifying the weakest and strongest value propositions, and thereby optimizing investment decisions. Here's an overview:

- Machine Learning (ML) - ML is a key part of AI where systems learn from data to get better at tasks without being explicitly programmed. It's behind applications like image recognition and virtual assistants. The global ML market is expected to hit $408.4 billion by 2030.

- Deep Learning (DL) - DL uses deep neural networks to find patterns in big datasets, making strides in areas like image and speech recognition. The global DL market could reach $1.19 trillion by 2033. We wrote an article specifically about this subset.

- Natural Language Processing (NLP) - NLP helps computers understand and generate human language, useful for things like translation and chatbots. The global NLP market is set to hit $209.91 billion by 2029.

- Neural Networks - These mimic how brains work and are highly efficient for tasks like recognizing images and speech. Neural networks excel in tasks like image and speech recognition, powering various AI applications. The market could reach $152.61 billion by 2030.

- Cognitive Computing - This AI subset imitates human thought processes, recognizing patterns and interacting naturally with humans. The cognitive computing market is expected to hit $99.3 billion by 2027.

- Computer Vision - This AI lets machines understand visual information, like images and videos, and is changing industries like healthcare and automotive. Computer vision could grow to a $45.7 billion market by 2028.

PE Deal Activity and Investment Rounds

Private equity investors have been very active - private investments in generative AI hit $178 million in 2023 and are expected to reach $1.096 billion by 2033. According to a study, a total of 315 private equity firms with current investments in AI and ML were counted in 2023, with a total of 573 investments made between 2013 and 2023, including 52 exits.

OpenAI - Raised $10 billion in funding from Microsoft, Thrive Capital, and others in 2023, valuing the company at over $29 billion.

Anthropic - Raised $200 million in Series B funding led by Dustin Moskovitz's Good Ventures in 2023, bringing its total funding to over $300 million.

Figure AI - Raised $675 million in a Series B funding round, bringing its pre-money valuation to $2.6 billion. Jeff Bezos, Microsoft, Nvidia, OpenAI, Intel, LG, and Samsung participated in the round.

Databricks - Raised $684 million in Series H funding led by Morgan Stanley in 2023, bringing its valuation to $43.2 billion.

Inflection AI - Raised $1.3 billion in Series A funding led by Dustin Moskovitz and Sam Altman in 2023, one of the largest Series A rounds ever.

Investment Drivers and Strategies

When assessing an AI investment target, private equity firms look at specific aspects, counting:

Technology and Innovation - The company's AI tech uniqueness, sophistication, and competitive advantage.

Market Opportunity - The market size, growth potential, and target audience for the AI solution should be carefully considered, especially as many new ventures are targeting niches.

Value Proposition - What does the AI actually address? Critical pain points? Tangible benefits to customers?

Monetization Strategy - While many AI companies adopt a freemium model, diversifying revenue streams through licensing, subscriptions, or bespoke enterprise agreements can enhance financial sustainability.

Customer Traction and Validation - Demonstrated user adoption and positive feedback underscore market readiness and scalability.

Team and Talent - Navigating industry challenges and driving innovation require strong leadership expertise, vision, and technical capabilities.

Data Strategy and Quality - Strong data governance and access to diverse, high-quality datasets are pivotal for AI technology efficacy.

Regulatory and Ethical Considerations - Preemptively addressing regulatory constraints and ethical implications signals long-term viability and responsible AI deployment.

Competitive Landscape - Understanding direct competitors and potential disruptors helps effective market positioning and highlights unique selling points.

The Main Players

OpenAI - OpenAI is known worldwide as the reference in AI, through its ChatGPT chatbot. It develops advanced AI models and technologies while promoting ethical AI research. It has contributed to breakthroughs in natural language processing and reinforcement learning.

InWorld - InWorld develops AI-driven virtual reality (VR) and augmented reality (AR) solutions for immersive experiences and training simulations. They combine AI with VR/AR technologies to create interactive and realistic environments.

Anthropic - Anthropic focuses on advancing artificial general intelligence (AGI) research and developing AI technologies that can understand and learn from diverse sources of information. They aim to create more robust and scalable AI systems capable of solving complex problems.

C3.ai - C3.ai is a leading enterprise AI software provider for accelerating digital transformation. They offer a suite of products for various industries, leveraging machine learning algorithms to optimize processes and deliver insights.

Figure AI - Figure AI is pioneering the world's first commercially viable autonomous humanoid robot, Figure 01. With expertise in AI and humanoid technology, they aim to revolutionize industries, addressing labor shortages and enhancing productivity and safety. Their commitment to innovation sets them apart in the AI robotics sector.

Future Outlook and Predictions

As we’ve seen, everything points to explosive growth. In the eyes of many, we are still in the early stages of the AI revolution. According to Bloomberg, generative AI is expected to reach $1.3 trillion by 2032 and capture 10-12% of total tech spending by the same time. AI is expected to continue to significantly transform industries worldwide, e.g. healthcare, finance, software, hardware, software, services, advertising, gaming … and cut the equivalent of 300 million full-time jobs in the process.

We could spend hours describing the infinite scope and use cases triggered by AI. Let's also not forget the rise of AI infrastructure - from chips to server and storage solutions - as both individuals and businesses are eager to harness the increasingly demanding computing power of AI. From an investor standpoint, it’s all about being able to identify the right players and hold onto them. Let's keep in mind that the tech behemoths will continue to dominate and snatch up any promising player, which can in turn create very fruitful exit scenarios for investors in the short term.

The Bottom Line

In our view, although the AI space is experiencing a boom, identifying the most promising players with a true, sustainable value proposition is challenging. We see some similarities with the dotcom bubble, in that many will fall into the void while the strongest will remain. It is therefore essential for investors to gain an in-depth understanding of the sector before committing capital to it.

At Acquinox Capital, we draw on our deep sector expertise and extensive network to navigate this complex landscape and pick the most promising players. Our team constantly analyzes market trends, assesses technological innovations and conducts rigorous due diligence to identify opportunities that offer compelling long-term returns.

Published by Samuel Hieber