The mobile gaming industry is thriving. Within the broader gaming industry, it is at the forefront of technological innovation and revenue growth. As a growing number of investors seek to capitalize on evolving consumer behaviors and digital entertainment trends, understanding the dynamics is key.

In this article, we will examine key trends for 2024 that investors need to watch. We will focus on how innovations like augmented reality and blockchain are driving growth, and analyze changing player preferences and market dynamics.

In this article, we will examine key trends for 2024 that investors need to watch. We will focus on how innovations like augmented reality and blockchain are driving growth, and analyze changing player preferences and market dynamics.

Recent Developments in Mobile Gaming

The mobile gaming sector has seen significant changes in the last few years, driven by key trends. Subscription and free-to-play games have become more popular, giving players more options and making gaming more accessible. The adoption of metaverse concepts has introduced new immersive experiences and social interactions in mobile games, while blockchain technology and non-fungible tokens (NFTs) have allowed players to own in-game assets, adding value and scarcity. Cloud gaming services have made great strides, offering seamless gaming experiences across devices without requiring high-end hardware.

Game diversity has also increased, catering to a wider range of tastes and demographics. Finally, innovations in augmented reality (AR), virtual reality (VR), and mixed reality have expanded immersive gaming possibilities, providing players with unique and engaging experiences.

Outlook for 2024

Continued Growth of the Mobile Gaming Market

We believe that two main factors are driving the growth of the mobile gaming market. First, the increasing global penetration of smartphones and mobile devices has vastly expanded the potential player base. 54% of the world's population - 4.3 billion people - own a smartphone. This statistic indicates continued rapid growth for the global mobile gaming industry, with a predicted increase in the number of mobile gamers to 2.723 billion by 2025.

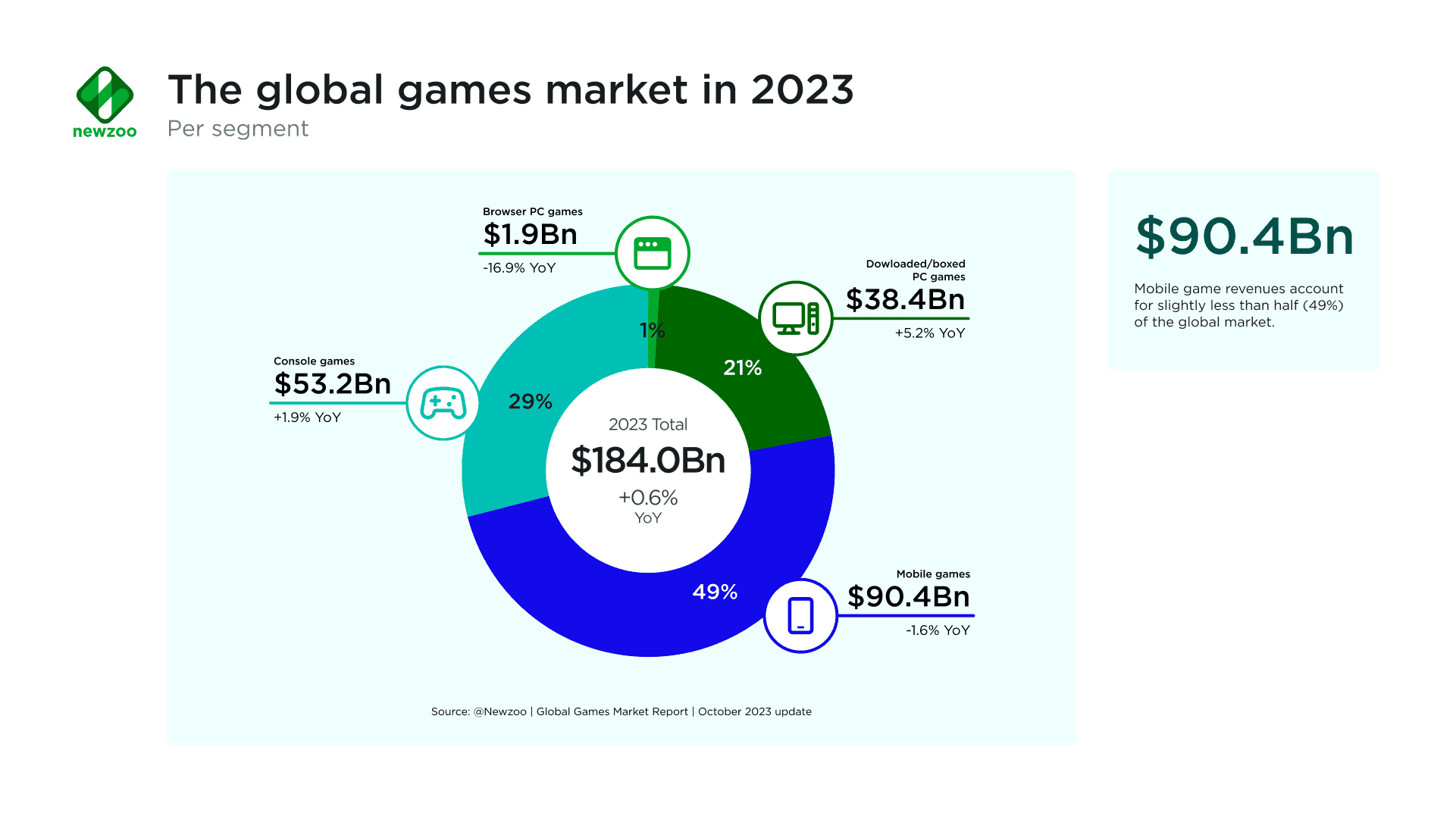

Second, the accessibility and convenience of mobile gaming appeal to a broad audience, including casual gamers and those seeking on-the-go entertainment. In 2023, mobile games continued to dominate the gaming market, with a 49% share. The adoption of various monetization strategies like in-app purchases, subscriptions, and advertising continues to contribute significantly to the market's growth by providing developers with diverse revenue streams. Mobile game sales amounted to $124 billion in 2023 and are forecast to reach $195 billion in 2030.

Impact of App Stores Environment

The app store environment has been in the news lately, spotlighting the dominance of platforms such as Apple's App Store and Google Play, which are coming under increasing regulatory scrutiny and policy changes with significant consequences for developers and publishers. Recent investigations and legal actions have highlighted concerns about app store policies on fees, app discovery, and data privacy.

A notable example is the lawsuit brought by Epic Games (the developer of the popular game Fortnite) against Apple, over the 30% reduction in its revenue from in-app purchases. The lawsuit resulted in a court ruling that Apple's anti-skimming provisions, which prohibit developers from directing users to other payment methods, breached California's unfair competition law.

At the beginning of the year, regulations have compelled Apple to tear down some of the competitive barriers it built around its ecosystem. This move will grant users access to alternative stores and payment systems. For developers, these changes present an opportunity to reach a wider audience and leverage those alternative payment systems, giving them greater control over pricing and revenue.

Emerging of New Gaming Genres

The mobile gaming industry is witnessing a wave of new gaming genres and subgenres, reflecting evolving player preferences and industry innovation. According to a report by Newzoo, social casino games, idle games, and narrative-driven experiences are trending genres, each catering to specific player interests and engagement levels.

Hyper-casual Games: Though they are declining in terms of downloads recently, the genre remains one of the most widely played, characterized by its lightweight nature, basic mechanics, and instant gameplay. These games are designed to be easy to pick up and play, with simple interfaces to promote accessibility.

Mid-core Games: Mid-core games are driving most of mobile gaming’s revenue, with RPG and strategy genres leading the way. The two top-grossing games of the genre in 2023 were Honor of Kings and Genshin Impact, having generated respectively $1.48 billion and $948.5 million. RPGs are particularly popular in the mobile gaming industry in Asia, while other mobile gaming markets have more variety in terms of revenue-driving genres.

Puzzle Games: Puzzle games are a favorite subgenre of mobile gamers. Candy Crush is a prime example, dominating the sub-sector with over 270 million users and $2 billion in player spending. Developers are adding extra gameplay and meta-layers to puzzle games to target a broader audience, including female gamers and enthusiasts of storytelling, design, or logic puzzles.

Hybrid Casual Games: With hyper-casual games seeing a decline in downloads, game publishers are turning to hybrid casual games, also known as “hyper-casual 2.0”. These games have proven to perform way higher, generating 800% more revenue per user and boasting better engagement metrics, such as average time spent per month and session length.

Mobile game content continues to expand, contributing to an ever richer, more dynamic ecosystem, which also underlines the overwhelming demand. Mobile games accounted for 55.6 billion downloads in 2023, out of a total of 148.2 billion apps and games downloaded that year. And according to Misplay, 50% of the total gaming industry’s revenue will be coming from mobile gaming by 2030.

Focus on Localization and Global Expansion

As mobile gaming expands globally, there is a growing emphasis on localization and strategies for international audience engagement. The Asia-Pacific region, with its large population of mobile users and cultural diversity, presents significant market opportunities for developers. The Asia-Pacific (APAC) region generated 64% of global mobile gaming revenue in 2023, reaching $124 billion. Chinese gamers alone accounted for 34% of the total consumer spending on mobile games in 2023. And this year, the mobile games market in China is projected to generate revenue of $34.66 billion.

China Mobile Games Revenue. Source: Niko Partners, June 2023

Access to Capital is to Remain Difficult

On the flip side, the landscape of investment in mobile game development has become increasingly challenging. Even a basic hyper casual game can cost over $20,000 to develop, making entry into the industry more difficult for small studios. Investors now demand rigorous preliminary metrics and clear profitability forecasts before committing funds, especially as expenses quickly multiply with each project iteration. This poses a significant hurdle for new entrants without an established track record.

Unlike in the past, where concept potential alone could attract investment, today, only projects with proven market appeal and strong development teams have a chance of securing backing. This shift reflects a broader trend towards cautious investment strategies, driven by normalized market growth and diminished margins, where returns on investment may take 18 to 24 months to materialize.

Investable Players in the Mobile Gaming Sector

Established Private Game Players

The private mobile games sector is highly fragmented. The Game Unicorn index, though, provides a handy list of the main players:

Epic Games: Epic Games stands out with its blockbuster mobile game Fortnite, captivating millions of players worldwide. The game is making its return this year to mobile app stores, after a three-year absence. Epic Games also plans to launch its own app store, the Epic Games Store, offering developers a 12% cut, as opposed to the 30% royalty imposed by Apple. This initiative could prove highly beneficial to the company as it challenges Apple's control, fostering the emergence of a fairer app store landscape for developers.

ByteDance: While famous for TikTok, ByteDance has also entered the gaming realm with titles like "Puzzly" and "Flipagram".

NetEase: As a major player in China's mobile gaming scene, NetEase has developed and published hit titles like Knives Out and Identity V, solidifying its position as a powerhouse in the competitive mobile gaming market.

Animoca Brands: Animoca Brands leads the charge in integrating blockchain technology into mobile gaming, offering innovative titles like The Sandbox and Crazy Defense Heroes that push the boundaries of traditional gameplay experiences.

Smilegate: Smilegate's influence extends across mobile gaming, particularly in South Korea, where its online games like CrossFire enjoy massive popularity among mobile gamers.

Niantic: The developer's main title, Pokémon GO, has generated over $5 billion since 2016 and has been downloaded more than 1 billion times globally.

Playtika: Playtika dominates the mobile social casino gaming market with titles such as Slotomania and House of Fun.

Indie Studies and Startups

Indie studios and startups play a vital role in driving innovation and diversity within the mobile gaming industry. These small, agile teams often bring fresh ideas, innovative gameplay mechanics, and unique storytelling to the table, pushing the boundaries of creativity and driving industry-wide innovation. They often focus on niche genres or experimental gameplay mechanics that larger companies might overlook.

Games like Monument Valley (by ustwo games), Stardew Valley (by ConcernedApe), and Among Us (by InnerSloth) have achieved critical acclaim and commercial success, showcasing the creative potential of independent developers.

Tech Giants Influence

All things considered, tech giants like Apple, Google, and Meta (formerly Facebook) wield substantial influence over the mobile gaming ecosystem. Apple's App Store and Google's Play Store serve as primary distribution platforms for mobile games, shaping market trends and developer strategies. Meta, with its focus on virtual reality (VR) and augmented reality (AR), is exploring new frontiers for immersive gaming experiences. These companies also heavily invest in mobile gaming infrastructure, with initiatives like Apple Arcade and Google Play Pass offering subscription-based models for premium gaming experiences.

Speaking of subscription-based models, Netflix is also venturing into the sector. Departing from conventional approaches, Netflix Games offers its subscribers a collection of in-house games, which resulted in a remarkable 180% year-on-year increase in downloads. This move differentiates Netflix from competitors such as Amazon Prime Video and Disney+, who have yet to integrate games into their platforms. Though, we can expect more of these non-gaming digital entertainment behemoths to follow suit, creating an even more competitive space …

Companies Leveraging Blockchain

Blockchain technology and non-fungible tokens (NFTs) are revolutionizing ownership and monetization in gaming, with companies like Sky Mavis (creators of Axie Infinity) leading the charge. "Blockchain technology is poised to revolutionize the gaming industry by enhancing security, enabling true ownership of in-game assets, introducing innovative economic models, and promoting interoperability".

Other prominent names such as Decentraland, a blockchain-based virtual world, and The Sandbox, a user-generated content platform, are also at the forefront of this movement, shaping the future of blockchain gaming.

Conclusion

The mobile gaming industry is one of the most dynamic and evolving, propelled by trends and innovative ideas that are revolutionizing interactive entertainment as we know it. From the rise of hyper-casual games and the integration of metaverse concepts to the revolutionary advances of blockchain technology and cloud-based gaming services, the landscape is bursting with innovation and potential.

As private market advisors experienced in identifying market trends and navigating complex dynamics, we at Acquinox Capital understand the importance of staying ahead of the curve. We believe that stakeholders and investors in the mobile gaming sector should closely monitor these emerging trends and technologies for promising opportunities. By embracing these developments and gaining an in-depth understanding of market dynamics, one can position itself for success in this dynamic and expanding industry.

Published by Samuel Hieber