Last year saw a huge increase in secondary transactions - by more than 90%. Behind this is the massive amount of capital tied up in unsold companies in portfolios around the world, highlighting the challenge investors face in getting their capital back when they want it.

What was once a niche is now a cornerstone of the private equity space, a thriving ecosystem that offers investors unique opportunities for liquidity, portfolio rebalancing, and access to exclusive opportunities. Let's see what it's all about.

The Current Landscape

In private equity, illiquidity has always been a given. And when exits are scarce, investors turn to the secondary market for help. This sector has undergone massive transformation and growth in recent years, mostly driven by technological advances. Last year, secondary transactions amounted to more than $100 billion - one of the record years in this space.

Last year, Bain & Company found that portfolios around the world were slammed by a colossal $3.2 trillion in unrealized value, entangled with more than 28,000 unsold companies. As a result, limited partners (LPs) are seeking more liquidity, driven by needs like rebalancing portfolios and realizing their performance. Over-allocation to private markets, driven by the recent volatility of the public market, also amplified that phenomenon. The result? Increased use of the secondary market.

A Quick Retrospective

As a reminder, the term "secondary" here refers to the buying and selling of existing private equity investments between market participants. Given the absence of an organized market, this solution increases investors' liquidity and flexibility in adjusting their portfolios.

Secondary funds have been in existence since before the global financial crisis. They initially served as investment pools, allowing LPs to sell their positions in GPs for quick cash when needed. It remained a niche market until the mid-2000s.

Since then, the secondary market has grown exponentially. Specialized marketplaces and platforms, which have facilitated transactions, have contributed to this growth - SecondMarket and SharesPost, set up in the mid-2000s, have played an important role in making the secondary market more liquid and accessible.

Growth Drivers and Trends

IPOs and Tender Offers - The success of IPOs, such as LinkedIn's in 2011, and tender offers, like those conducted by Facebook and Twitter ahead of their IPOs, have increased investor confidence in the secondary market. These events have also led to a greater awareness of the potential for liquidity in private companies.

Increased Activity and Volume - The growth of the secondary market has been marked by a significant increase in transaction volume. Since 2016, the tender offer transaction volume has increased more than tenfold, reflecting the growing demand for liquidity in private companies.

Global Expansion - The secondary market has expanded globally, with transactions now occurring in the United States, Canada, Europe, and South America.

New Players and Services - The rise of new players, such as Shareworks and Carta, has further increased the accessibility and efficiency of the secondary market. These companies offer services that facilitate transactions, such as tender offers and secondary sales, making it easier for investors to buy and sell stakes in private companies.

Advantages and Challenges

An Invaluable Solution for Buyers and Sellers

Sellers - Sellers' advantage is clear: They get a major boost: they can turn their existing, locked-in investments into cash, allowing them to cash in on their investments early and potentially pivot into new opportunities.

Buyers - On the other side, buyers get access to a wide range of investment options that might not be available in the primary market. These can include shares in well-established funds or direct investments in companies with proven track records.

Challenges in Pricing and Due Diligence

Pricing and due diligence are tough nuts to crack. One big issue is figuring out the right value for private equity investments because they are often not easy to sell and don't have clear market prices. The massive lack of data makes market participants speculate on how companies are doing and their value. Sellers sell at what they think is fair, providing an often-misleading benchmark price for buyers.

This makes proper due diligence highly challenging. Buyers have to rely on what the sellers tell them, which may not be accurate. Added to this are regulatory matters, as dealing with different regulations and jurisdictions makes deal execution even more complex.

Regulatory and Legal Considerations

Regulation plays a key role in secondary transactions. It ensures legal compliance and governs dealings. In typical transactions, legal agreements are central to setting sale terms such as price, payment structure, and any outstanding liabilities. Deal structures come in many forms and shapes; here is an interesting article on this topic. Regulatory bodies like the SEC in the US and the FCA in the UK oversee the industry, ensuring fair and transparent transactions.

Tax complexities arise from the broad investor base, which today includes companies, institutional investors, and individual investors. As tax laws vary from jurisdiction to jurisdiction, investors must carefully consider these factors to avoid liability. A few typical ones:

Capital gains tax implications.

Treatment of carried interest, management fees, and expenses.

Tax treatment of dividends and distributions received.

Potential tax implications of fund structures and jurisdictions.

Withholding taxes and international treaties between jurisdictions.

Consideration of pass-through entity taxation for certain fund structures.

Reporting requirements for foreign investments and income.

Emerging Opportunities

Tech and AI upsurge

The rise of tech unicorns has undoubtedly fueled the popularity of the secondary market. Names like Klarna, SpaceX, Revolut, and Epic Games have caught the attention of investors around the world, leading to an increase in investment activity as secondary platforms have become more accessible and transparent. The opportunity to be part of the next technological revolution is hard to pass up...

And for good reason. The exponential growth in the valuations of private technology companies over the last decade has been the source of many investor success stories. With the recent rise of AI, this trend is set to increase tenfold. As a result, investors, be they institutional or individual, are on the hunt for the next gem.

Increasing Demand for Liquidity

It goes without saying that private equity investments have, on average, performed much better than their public counterparts. Many existing investors have met their return targets. But only on paper. There are several reasons for this:

Staying Private - As private companies grow and become more valuable, they're staying private for longer periods. Investors who got in early when these companies were worth less are now looking to cash out at higher prices.

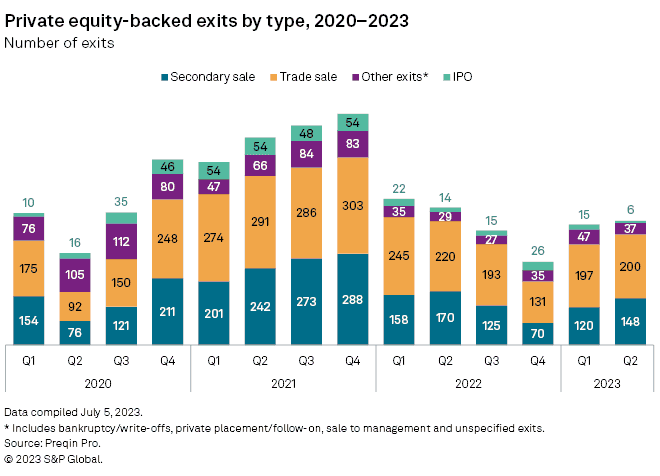

Decline in IPOs and M&A - There's been a clear drop in IPOs and M&As, which limits the usual ways for private equity investors to cash out. This shortage of exit options is pushing investors towards secondary transactions.

Denominator Effect - Sometimes, the value of private assets doesn't move as much or as quickly as that of public ones. This can throw off investors' asset allocations, making them want to sell private investments to rebalance their portfolios.

The emergence of new secondary co-investment platforms is a perfect fit for this need. They offer a lucrative liquidity solution for existing investors, allowing them to cash out their investments in record time. At the same time, they give buyers easy access to sought-after opportunities - a win-win situation.

Innovation in Deal Structures

Innovation in private equity deal structures, both in primary and secondary transactions, is in full swing. A notable trend is the clear will to facilitate individual investors' access to secondary private equity deals, which is supported by the introduction and expansion of new investment structures and regulations. In Spain, for example, a recent law has allowed the general public to participate in structured private equity vehicles for as low as €10,000.

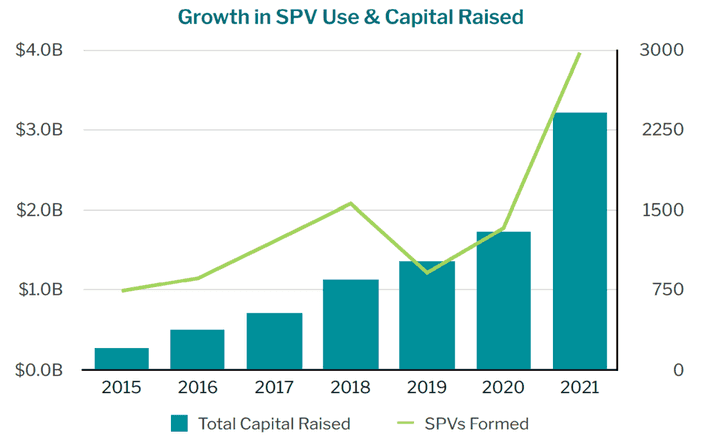

Growth in SPV use and capital raised. Source: Forbes

Behind that is the rise of special purpose vehicles, or SPVs. This investment structure allows managers to segregate their deals, manage risk more effectively, and streamline their portfolio management processes. It also allows them to improve tax efficiency and avoid regulatory complexities. For investors, SPVs offer greater transparency, making it easier to track the performance of their investments.

Future Outlook

There is no doubt that the secondary market's expansion is just beginning. As we have seen, investors are increasingly looking for liquidity as their private equity investments mature but are not liquidated. The growth of specialist secondary funds, with $117 billion available for transactions in 2023, underlines this need[5]. Meanwhile, co-investment platforms and innovative deal structures support this shift by appealing to a broader investor base. That said, technological advances are in some ways the foundation; we expect AI to bring huge changes to the industry, i.e., sourcing, transaction processes, decision-making, etc., while favorable regulatory environments are set in motion for even more investment activity.

Nonetheless, we would urge investors to remain cautious, as there are also some challenges ahead. The valuation complexity is one, as secondary prices are prone to being out of sync with primary prices, with transactions diluted by intermediaries, limited data, and differing investor sentiment. Second, massive sales on the secondary market for a given company can be a sign of trouble, leading to underperformance. Third, secondary sales also mean capital dilution and, given the opacity of some transactions, out-of-control cap tables for companies. In response, some companies have been known to void shares in the event of unauthorized secondary trading.

At Acquinox Capital, we are experts in the secondary market, navigating the challenges and seizing opportunities in this ever-changing ecosystem. Our team combines years of expertise and a proven track record to deliver strategic insights, innovative deal structures, and flawless execution, ensuring the best possible results for our clients.

Published by Samuel Hieber